I grew up in payments.

In the mid-90s, I cut my teeth on Standard Entry Class codes, Return Reason codes, and the logistics of batch clearing and time-based risk in ACH. I know. Sexy, right?

In Payments Land, geeks like me loved to talk shop. Still do.

Comic-Con and Star Trek conventions have nothing on regional payments conferences where payments nerds brandish obscure acronyms and flex arcane knowledge in passive-aggressive conversations about who’s liable for fraud in unusual transaction scenarios.

Today, most payments pros still think of payments in terms of technical categories based on who’s sending the payment, who’s receiving the payment, and which rules apply.

But this tactical mindset creates big blind spots; and blind spots can be dangerous, even fatal, when disruption is at the door.

Accenture predicts that banks risk losing $280 billion in payments revenue by 2025 as more payments become instant, invisible, and free.

So. What to do?

Today, when talking about real-time payments, the conversation usually turns to operations and fraud. How will clearing change? How will we comply with the new rules? How will fraud be identified, prevented, or remedied in real time?

While important, these are table-stakes concerns. The answers to all of the questions above will be roughly the same for everyone long term.

Few, however, are thinking strategically about how real-time payments will create opportunities to differentiate products and gain a competitive advantage.

And while ubiquitous real-time payments will enable faster loans, instant account verification, and better one-click experiences across numerous payment types and use cases, the better way to think about payments in the new era will come down to how financial institutions curate two very basic categories of user-experience (UX) at the moment of need.

For many financial institutions, some 60% of incoming support calls are triggered by payments.

Roughly 75% of Americans say they live “paycheck-to-paycheck.” For them, there is no such thing as a “small money problem.” One unfamiliar transaction or one unexpectedly low balance can feel like a disaster in the making. In this context, all consumers—regardless of age or income—want personal service: a live, local person who can resolve their moment of need at the first point of contact.

Therefore, financial institutions must address not so much the tactical question of which real-time fraud solution to put in place but the strategic question of how they will support the victims of real-time fraud in real-time. How to accomplish this without forcing consumers to navigate the convoluted menus of an Interactive Voice Response (IVR) system or to spar with a soulless chatbot that can’t understand, much less intuit, what the consumer needs.

The bottom line is that financial institutions that can translate personal service meaningfully into digital channels will be able to couple real-time payments with real-time support at the moment of need.

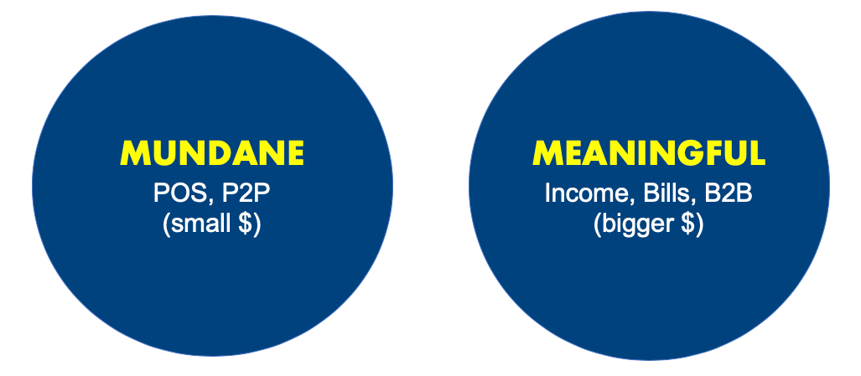

From the consumer experience perspective, there are only two payment categories that matter: the mundane and the meaningful.

Mundane payments are generally small-dollar, everyday point-of-sale (POS) and peer-to-peer (P2P) payments. Each payment, in and of itself, is not consequential.

Meaningful payments are generally larger-dollar transactions of consequence: your direct deposit (or paycheck), bill payments, business-to-business transactions, and wires.

Botching one meaningful payment can make or break a relationship with a customer or member. When meaningful payments become real-time, supporting those payments in real-time becomes a new imperative. Meaningful payments not only create the biggest opportunities to strategically differentiate on service; they also provide some of the best chances to sell in the context of that service.

And while mundane payments are, well, mundane, they too must be supported in real-time given the scarcity mindset of “living paycheck-to-paycheck” that governs most Americans. Taken together, mundane payments become meaningful. Financial institutions must make meaning of the patterns of spending that comprise mundane payments month-to-month. This means data analytics must be in place to surface and share insights across mundane payments in real time for better financial management.

As real-time payments approach, financial institutions must make the most of the meaningful and make meaning of the mundane in aggregate. Both require real-time support, and, despite the hype surrounding chat-bots and digital self-service, those financial institutions that translate live, personal service effectively into digital channels will be in the best position to capitalize on the upside of the biggest disruption to visit our industry in 50 years.

Like this article? Subscribe to the Strategically Speaking blog to gain access to weekly articles from our industry leaders right from your inbox!

Stay up to date with the latest people-inspired innovation at Jack Henry.

Learn more about people-inspired innovation at Jack Henry.

Who We Serve

What We Offer

Who We Are